The recent BHS

scandal demonstrates how unscrupulous

businessmen like Sir Phillip Green and

Dominic Chapple can accumulate large

personal fortunes by feeding, like vultures, off struggling companies. These so called entrepreneurs reportedly bent

the rules of business to breaking point,

subverted ethical standards, and ruthlessly exploited staff and investors to feed their insatiable greed for personal wealth. To coin an over-used phrase people like Sir Philip Green are, for many, the unacceptable face of capitalism. And here in Thanet I fear we have something akin to a BHS situation developing at

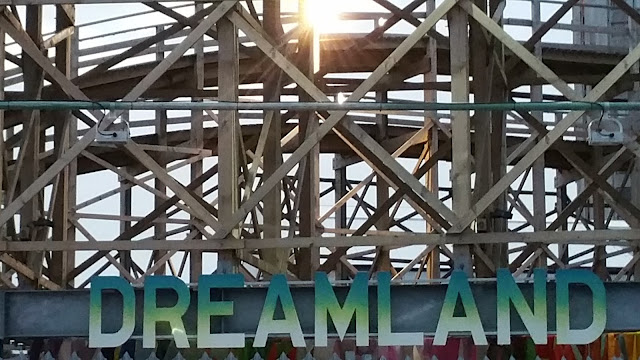

Margate’s iconic Dreamland

Amusement Park and here’s why I think so.

In November

2014 a company called Sands Heritage Limited, who’s directors include Mr Nicholas Con-nington and Mr John

Adams, was appointed by Thanet Council

as the operator of Margate’s Dreamland

Amusement Park. There was much

controversy surrounding Sand’s application to become Dreamland’s operator. It was a new company seemingly inexperienced

in running seaside amusement parks. There were also rumours that Sands allegedly enjoyed certain “advantages” over the other companies applying to become the Dreamland operator. These rumoured “advantages” have, to the best

of my knowledge, never been substantiated but, following a number of

complaints, Thanet Council took legal advice about the park operator procurement

exercise and disallowed much of Sands

Heritage’s application documentation during the final stage of the selection process. Like

many others, I am curious to know what Edi-vence of alleged wrong doing, the secret legal

advice contained – if indeed any at all??

Dreamland

opened to the public on 19 June 2015 and the controversy continued. Its key attraction, the scenic railway, was still being restored and not ready for use

by customers for several months to come. In October 2015 Sands Heritage

threatened to sue Thanet Council for breach of contract and alleged multi-million pound financial losses caused by the council's incompetence in managing the Dreamland project. Clearly

there was some substance to this claim and in November 2015 Thanet Council paid

Sands £912,000 in compensation. In December 2015, just 6 months after the

opening of Dreamland, Sands Heritage

announced that it owed a massive £2.9million in unpaid bills, much of this to small local

businesses. On 23rd December Sands reached a Company Voluntary

Arrangement with its 100 plus creditors, using some of the £912,000 from Thanet

Council to make an initial payment towards clearing the debt. By May 2016 it became clear

that Sands Heritage was still in serious financial difficulties resulting in

the appointment of Duff and Phelps as administrators of Sands Heritage. On

August 4th , at a meeting of its creditors, the true extent of Sands indebtedness became clear.

According to administrators Duff and Phelps’ report to the meeting, Sands owed a massive £8.34 million to almost 300

creditors many of them small local business who can ill afford even modest

losses.

Sands’ only secured creditor is, according to the Duff

Phelps’s report, Arrowgrass Master Fund Ltd, an investment company registered

in the offshore tax haven of the Cayman Islands which is owed £2,343 million plus any accruing

interest, charges and costs. The security on this debt is a charge on Sands’ 99 year leasehold of the Dreamland Amusement park. This means that

if Sands Heritage were to default on its repayments to Arrowgrass, go bust, be wound up or sold, which considering

the precarious state of its finances are

all likely options, then Arrowgrass will end up owning the Dreamland lease to do

with as it likes.

Now

this where things begin to get interesting, or perhaps questionable, depending

upon your point of view. Arrowgrass Master Fund Limited is owned by London

based Arrowgrass Capital Partners LLP. According to internet sources “Arrowgrass Capital was founded in 2008 by former Deutsche Bank traders.

The fund’s founder CIO is Nick Niell. The

other founders are Henry Kenner, James Barty, and Michael Sung Wook Chung”. Arrowgrass

appears to be a company which specialises in high risk, high return investments

particularly focused on companies struggling to keep their heads above water

like Sands Heritage. According to a disclaimer on the Arrowgrass website its investments are “intended

for sophisticated investors who can accept the risks associated with such an

investment including a substantial or complete loss of their investment and who

have no need for immediate liquidity in their investment. Investments will be

subject to strict limitations on transferability and withdrawal”.

Now

this where things begin to get interesting, or perhaps questionable, depending

upon your point of view. Arrowgrass Master Fund Limited is owned by London

based Arrowgrass Capital Partners LLP. According to internet sources “Arrowgrass Capital was founded in 2008 by former Deutsche Bank traders.

The fund’s founder CIO is Nick Niell. The

other founders are Henry Kenner, James Barty, and Michael Sung Wook Chung”. Arrowgrass

appears to be a company which specialises in high risk, high return investments

particularly focused on companies struggling to keep their heads above water

like Sands Heritage. According to a disclaimer on the Arrowgrass website its investments are “intended

for sophisticated investors who can accept the risks associated with such an

investment including a substantial or complete loss of their investment and who

have no need for immediate liquidity in their investment. Investments will be

subject to strict limitations on transferability and withdrawal”.

It surprised many people to learn that prior to opening the Sands Hotel

in Margate and setting up Sands Heritage

Ltd company director Nicholas Con-nington reportedly worked for Arrowgrass

Capital Partners reportedly for a period

of 4 years. It has also emerged that

Con-nington’s colleague director at Sands Hotel and Sands Heritage, John Adams,

was the director of company called Lifescan Limited

alongside Arrowgrass founder Nicholas “Nick” Neil.

But the close ties between Con-nington,

Adams, and the founder of Arrowgrass don’t end there. In March 2016 Adams and

Con-nington set a company called Brede Hotels Ltd. In the statement of capital

published on the Companies House website Mr Nicholas Graham Niell is listed as

owning 100 shares in Brede Hotels. Brede Hotels Ltd appears to be the sole

owner of Nyland Rock Hotel Margate Ltd, which was set up by Adams and

Con-nington in May 2016, just before the Nyland Rock Hotel was sold for a

reported £1.75 million to Tower Pension Fund Trustees on 1 July 2016. According

to Companies House records, the receivers have now been called in to Tower

Trustees.

Now I’m not suggesting for a moment any

illegality or law breaking. But what does concern me is the ethical background to this saga. In effect the

directors of a troubled business (Sands Heritage) have a long standing

relationship with one of the directors (Nick Niell) of a company (Arrowgrass) which has lent them a

significant amount of money. The 2 sets of directors have also, as recently as

March – May 2016, established joint business ventures together (setting up Brede

Hotels Ltd/ Nayland Rock Hotel Margate

Ltd).

I’m sure that this is no more than a case of

business mates innocently helping each other out. But as I have stated in earlier postings

there is something important that needs to be publically clarified in order to reassure

everyone that the relationship between Sands Heritage and Arrowgrass is ethically

kosher. That is for Con-nington and Adams to declare whether or not they, or their

relatives, have investments in Arowgrass

or its related companies including

Arrowgrass Master Fund Limited.

If

they do, then many people might argue that Con-nington and Adams through

returns on any investment they might have in Arrowgrass, might make a profit from the failure of their own company, Sands Heritage. Bearing in mind the fact

that Thanet taxpayers have spent, to date, at least £9 million to purchase, restore

and open Dreamland (with more to come)

and that at least the same has been spent on the park via Sea Change, Coastal

Communities and Heritage Lottery grants.

Then taking into account the economic damage caused, particularly to small

businesses, by the Sands Heritage failure to pay £8.34 million bills; I think

that that there would considerable,

widespread and entirely justifiable, anger if it transpires that Nicholas

Con-nington and John Adans, through their relationship with / any investments in,

Arrowgrass, were to profit from the failure of their company, Dreamland operator,

Sands Heritage Ltd.

|

| The Geezas From Arrowgrass - Would You Buy A Used Amusement Park From Them? |

On 20th June I called out

Con-nington and Adams on this blogsite. I said “Nick Connington and John Peter Anthony Adams need to make a

public statement in answer to my simple question – do either of them (or their

relatives or friends) have any financial interests (shares, loans or

investments ) in Arrowgrass Master Fund

Ltd or any of its associated companies?

I am sure that Messers Connington

and Adams have nothing to hide and will be happy provide a truthful answer my question, which

hopefully will be no”. Almost 2 months

later they have made no public response to this important ethical demand. Now

we have fuller picture of what has been happening at Dreamland its more

important than ever before for the people of Thanet to know what is happening.

So once again I call out Con-nington and Adams to make a public statement in

answer to my simple question – do either of them (or their relatives or

friends) have any financial interests (shares, loans or

investments ) in Arrowgrass Master Fund

Ltd or any of its associated companies. Like millions of people I was

sickened and angered by the way in which the collapse of BHS massively enriched

its owners at the expense of its staff and investors. I don’t want Dreamland to

become another BHS and nor do thousands of Thanet residents. So come on Sands

Heritage bosses do the right thing and make that statement.

Well researched Ian. But with Pleasurama and with Dreamland TDC has been outplayed and mugged. TDC better start saving for cliff safety work at Pleasurama now.

ReplyDeleteWell done Ian and stage how Phelps the administrator under Benjamin Wiley went to great lengths (I still have the Gazette article) to say there was no charges on Dreamland? Now apparently there are. As fishy as Bob Bayford and Terry Painter's Pleasurama?

ReplyDeleteNo doubt Sands and Arrowgrass etc will end up with nothing to do with Dreamland as Pleasurama: TDC can simply cancel the 99 year lease.

You cannot just cancel a lease well not without paying massive financial compensation. Dreamland in my view is not viable, It has never made a trading profit up until the creditors meeting. I doubt it has made a profit since then but there is no information in the public domain. Its major attraction has been out of action for all of August the one month Dreamland might have turned in profit

ReplyDeleteIt is probably that Dreamland will be liquidated in the Autumn. The administrators will be looking to maximise the vale of the assets so the Autumn would be a good time to close it down